Next 24 hours: Market still digesting Wednesday updates

Today’s report: Takeaways into Thursday

The two big events driving markets into Thursday have been the latest US inflation data and the Fed decision. On net, we think we’re seeing a bigger reaction to the softer US CPI read, which the market believes will translate to dovish tweaks from the Fed going forward.

Wake-up call

- industrial production

- economic data

- upcoming BOJ

- employment data

- cut odds

- risk assets

- Fed outlook

- Macro themes

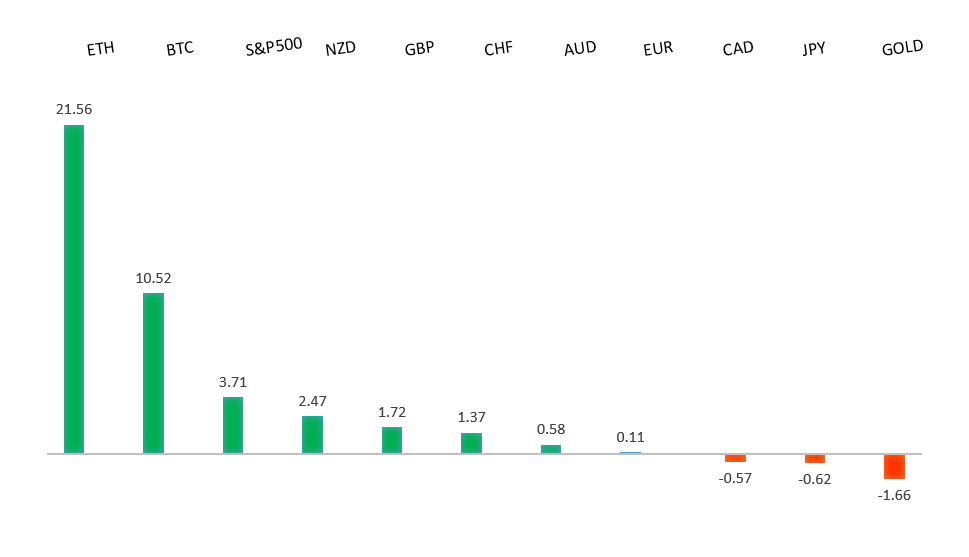

Peformance chart: 30-Day Performance vs. US dollar (%)

Suggested reading

- Roaring Kitty Returns to the Meme Stock Crowd, E. Dellinger, Fisher Investments (June 9, 2024)

- Stock Investors Have Already Won the Election, J. Rekenthaler, Morningstar (June 10, 2024)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The Euro has been in a multi-month consolidation since bottoming out in 2022. Setbacks have since been exceptionally well supported on dips below 1.0500, with a higher platform sought out ahead of the next major upside extension. Look for a push through the 2023 high at 1.1276 to strengthen the constructive outlook and extend the recovery run towards 1.2000. Only back below 1.0400 negates.EURUSD – fundamental overview

Most of the latest price action comes from the US Dollar side of the coin, where the Buck has been hit on the whole after the softer US CPI data. Euro rallies were however capped after the Fed left rates on hold and delivered a more hawkish than expected communication. Key standouts on Thursday’s calendar come from German wholesale prices, Eurozone industrial production, US producer prices, US initial jobless claims, and some Fed speak.EURUSD - Technical charts in detail

GBPUSD – technical overview

Signs have emerged of the market wanting to put in a longer-term base after collapsing to a record low in September 2022. The door is now open for the next major upside extension towards the 2023 high at 1.3143. Any setbacks should be well supported ahead of 1.2000.GBPUSD – fundamental overview

The Pound was able to more than recover from a round of softer UK manufacturing and construction data, with the currency more focused on a yield differential advantage post the softer US inflation data. However, we have since seen selling of the Pound into rallies after the Fed leaned a little more hawkish with its communication. Key standouts on Thursday’s calendar come from German wholesale prices, Eurozone industrial production, US producer prices, US initial jobless claims, and some Fed speak.USDJPY – technical overview

The market remains confined to a strong uptrend, most recently extending to a multi-year high through 160.00. Key support comes in at 151.95, with only a weekly close below to delay the constructive outlook.USDJPY – fundamental overview

A lot of the attention over the coming sessions will be on the upcoming BOJ decision and whether or not we get any tweaks to policy. As far as data goes, Japan's CGPI accelerated from 1.1% to 2.4% in May, above the consensus of a 2.0% increase. This marks the fastest annual rise in nine months. Key standouts on Thursday’s calendar come from German wholesale prices, Eurozone industrial production, US producer prices, US initial jobless claims, and some Fed speak.AUDUSD – technical overview

There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.6200 would give reason for rethink. Back above 0.6900 will take the big picture pressure off the downside and strengthen case for a bottom.AUDUSD – fundamental overview

Aussie employment data came in better than expected on the whole, though this hasn't really factored into price action. Instead, the Australian Dollar is contending with market reaction to Wednesday's soft US CPI data and more hawkish leaning Fed communication. Key standouts on Thursday’s calendar come from German wholesale prices, Eurozone industrial production, US producer prices, US initial jobless claims, and some Fed speak.USDCAD – technical overview

Above 1.3000 signals an end to a period of longer-term bearish consolidation and suggests the market is in the process of carving out a more significant longer-term base. Next key resistance now comes in up into the 1.4000 area. Setbacks should be very well supported down into the 1.3000 area.USDCAD – fundamental overview

Odds the Bank of Canada will cut rates in July have jumped to about 75% and the Canadian Dollar has suffered overall as a consequence. And while US CPI data came in soft, a hawkish leaning Fed communication was offsetting and has inspired renewed Canadian Dollar selling. Key standouts on Thursday’s calendar come from German wholesale prices, Eurozone industrial production, US producer prices, US initial jobless claims, and some Fed speak.NZDUSD – technical overview

Overall pressure remains on the downside with the market continuing to stall out on runs up into the 0.6500 area. At the same time, there are some signs of the market wanting to put in a longer-term base. Ultimately, a break back above 0.6500 would be required to take the medium-term pressure off the downside and encourage this prospect. A monthly close below 0.5800 will intensify bearish price action.NZDUSD – fundamental overview

The New Zealand Dollar has been a beneficiary of the risk on flow in the aftermath of the latest soft CPI print out of the US, which has fueled renewed demand for risk correlated assets. Rallies have however stalled out on the more hawkish leaning Fed communication. Key standouts on Thursday’s calendar come from German wholesale prices, Eurozone industrial production, US producer prices, US initial jobless claims, and some Fed speak.US SPX 500 – technical overview

Longer-term technical studies continue to look quite extended, begging for a deeper correction ahead. At the same time, the latest bullish breakout to a fresh record high beyond the 2024 high opens the door for the next measured move upside extension targeting the 5650 area. Key support comes in at 5194.US SPX 500 – fundamental overview

Though we have seen a healthy adjustment of investor expectations towards the amount of rate cuts in 2024, the market still hopes policy will end up erring more towards the investor friendly, accommodative side of things. This bet has kept stocks well bid into dips and consistently pushing record highs. Still, if there is a sense the Fed will need to be more sensitive towards erring on the side of higher rates, it could invite major disruption to the stock market.GOLD (SPOT) – technical overview

The 2019 breakout above the 2016 high at 1375 was a significant development, opening the door for fresh record highs and this next major upside extension into the 2500-3000 area. Setbacks should now be well supported above 2000 on a monthly close basis.GOLD (SPOT) – fundamental overview

The yellow metal has pushed record highs in 2024 with solid demand from medium and longer-term accounts. These players are more concerned about inflation, geopolitical risk and a less upbeat global growth outlook. All of this should keep the commodity well supported, with many market participants also fleeing to the hard asset as the grand dichotomy of record high equities and record low yields comes to an end.