Today’s report: Careful what you wish for

We come into Friday with investors getting everything they could have wanted with respect to what they’d like to see to force the Fed into taking a friendlier policy track. This week’s inflation data out of the US came in soft and this latest US initial jobless claims ran up to the highest level in two years.

Wake-up call

- Eurozone inflation

- BOE speak

- Yield differentials

- China housing

- slumping oil

- Slumping stocks

- about inflation

- Global outlook

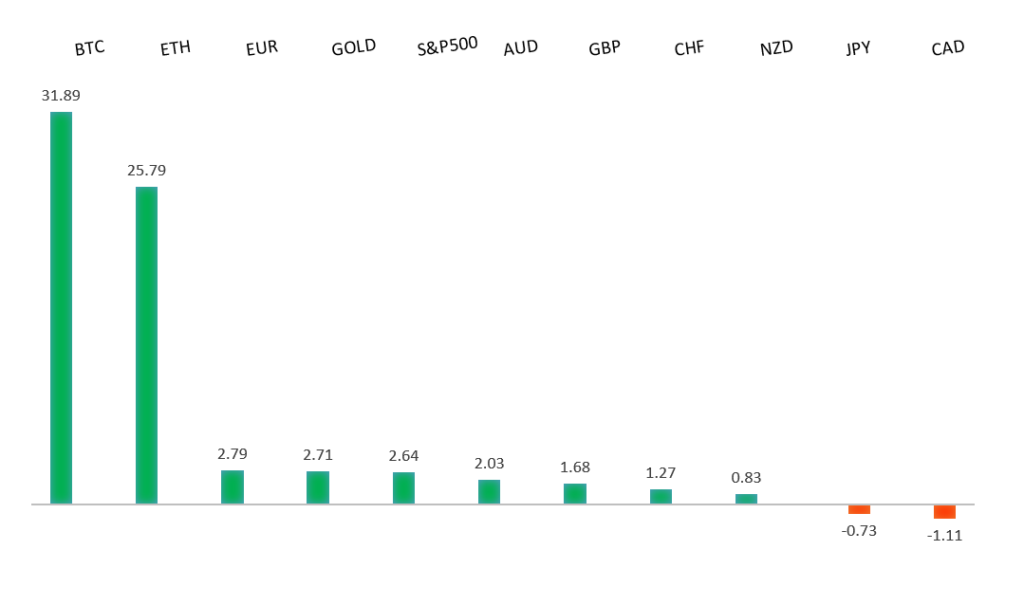

Peformance chart: 30 Day Performance vs. US dollar (%)

Suggested reading

- The Creator Economy: $250 Billion Industry Here To Stay, A. Perelli, Insider (November 16, 2023)

- This is just the beginning…., J. Parets, All Star Charts (November 15, 2023)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The Euro has been in a multi-month consolidation since bottoming out in 2022. Setbacks have since been exceptionally well supported on dips below 1.0500, with a higher platform sought out ahead of the next major upside extension. Look for a push through the yearly high at 1.1276 to strengthen the constructive outlook and extend the recovery run towards 1.2000. Only back below 1.0400 negates.EURUSD – fundamental overview

Absence of any meaningful first tier data out of the Eurozone on Thursday left the single currency tracking with bigger picture flows and mostly consolidating on the day. Key standouts on Friday’s calendar come from UK retail sales, the Eurozone current account, Eurozone inflation, Canada producer prices, US building permits, US housing starts, and scattered central bank speak from various officials at the ECB, BOE, and Fed.EURUSD - Technical charts in detail

GBPUSD – technical overview

Signs have emerged of the market wanting to put in a longer-term base after collapsing to a record low in September 2022. The November 2022 monthly close back above 1.2000 strengthens this prospect. Any setbacks should now be well supported ahead of 1.2000. Next key resistance comes in at 1.2681.GBPUSD – fundamental overview

There was a lot of talk out from various BOE officials on Thursday, though most of it leaned more hawkish. BOE Ramsden saw restrictive rates for an extended period, while BOE Greene talked about how it would be harder to get inflation from 5% to 2%. Key standouts on Friday’s calendar come from UK retail sales, the Eurozone current account, Eurozone inflation, Canada producer prices, US building permits, US housing starts, and scattered central bank speak from various officials at the ECB, BOE, and Fed.USDJPY – technical overview

The market remains confined to a strong uptrend, with sights set on a retest and break of the multi-year high from 2022 at 151.95. A push through this level will open the next major upside extension towards 155.00. Key support comes in at 147.30, with only a break below to delay the constructive outlook.USDJPY – fundamental overview

Most of the Thursday price action in the Yen was around a continued adjustment of yield differentials in the Yen's favor. There has also been a lot more of a tentative feel from Yen sellers on account of worry over possible intervention on USDJPY moves to the topside from current levels. Key standouts on Friday’s calendar come from UK retail sales, the Eurozone current account, Eurozone inflation, Canada producer prices, US building permits, US housing starts, and scattered central bank speak from various officials at the ECB, BOE, and Fed.AUDUSD – technical overview

There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.6200 would give reason for rethink. Back above 0.6523 will take the immediate pressure off the downside and strengthen case for a bottom.AUDUSD – fundamental overview

Softer China housing data and some mixed Aussie employment data have factored into some of the Aussie selling into the end of the week. Key standouts on Friday’s calendar come from UK retail sales, the Eurozone current account, Eurozone inflation, Canada producer prices, US building permits, US housing starts, and scattered central bank speak from various officials at the ECB, BOE, and Fed.USDCAD – technical overview

Above 1.3000 signals an end to a period of longer-term bearish consolidation and suggests the market is in the process of carving out a more significant longer-term base. Next key resistance now comes in up into the 1.4000 area. Setbacks should be very well supported down into the 1.3000 area.USDCAD – fundamental overview

Canada house starts rose slightly on Thursday. But this meant nothing with the price of oil plummeting. The net result was a Canadian Dollar that came right back under pressure. Key standouts on Friday’s calendar come from UK retail sales, the Eurozone current account, Eurozone inflation, Canada producer prices, US building permits, US housing starts, and scattered central bank speak from various officials at the ECB, BOE, and Fed.NZDUSD – technical overview

Overall pressure remains on the downside with the market once again stalling out on a run up into the 0.6500 area. At the same time, there are some signs of the market wanting to put in a longer-term base. Ultimately, a break back above 0.6056 would be required to take the immediate pressure off the downside and encourage this prospect. A monthly close below 0.5800 will intensify bearish price action.NZDUSD – fundamental overview

The New Zealand Dollar wasn't able to do much with an improvement in some Kiwi housing data, instead focusing in on slumping New Zealand stocks and softer housing data out of China. A slide in the commodities complex also wasn't of any help to the Kiwi rate on Thursday. Key standouts on Friday’s calendar come from UK retail sales, the Eurozone current account, Eurozone inflation, Canada producer prices, US building permits, US housing starts, and scattered central bank speak from various officials at the ECB, BOE, and Fed.US SPX 500 – technical overview

Longer-term technical studies are in the process of unwinding from extended readings off record highs. Look for rallies to be well capped in favor of lower tops and lower lows. A monthly close back above 4500 will be required to take the immediate pressure off the downside. Next key support comes in at 4308.US SPX 500 – fundamental overview

Investors continue to struggle with the reality of a higher for longer Fed policy track in the face of ongoing worry around inflation, while also contending with geopolitical risk. Overall, we expect inflation to continue to be a problem in 2023 that results in downside pressure into rallies despite recent data and market expectations that would argue otherwise.GOLD (SPOT) – technical overview

The 2019 breakout above the 2016 high at 1375 was a significant development, opening the door for fresh record highs. Setbacks should now be well supported above 1600 on a monthly close basis ahead of the next major upside extension. Next major resistance comes in at 2100, above which opens the next extension towards 2500.GOLD (SPOT) – fundamental overview

The yellow metal continues to be well supported on dips with solid demand from medium and longer-term accounts. These players are more concerned about inflation risk and a less stable and upbeat global growth outlook. All of this should keep the commodity well supported, with many market participants also fleeing to the hard asset as the grand dichotomy of record high equities and record low yields comes to an unnerving climax.