Next 24 hours: Yen drops to lowest level in nearly 5 years

Today’s report: Risk appetite turns up as 2022 gets going

We’re into 2022 and as we get going, the outlook is upbeat despite what would seem to be some serious concerns. But as far as worry around a tighter Fed policy track goes, the market is back to doubting the Fed will actually follow through.

Wake-up call

- sell interest

- COVID outlook

- macro themes

- Commodities slump

- panic button

- Kiwi underperforms

- Stocks vulnerable

- Dealers report

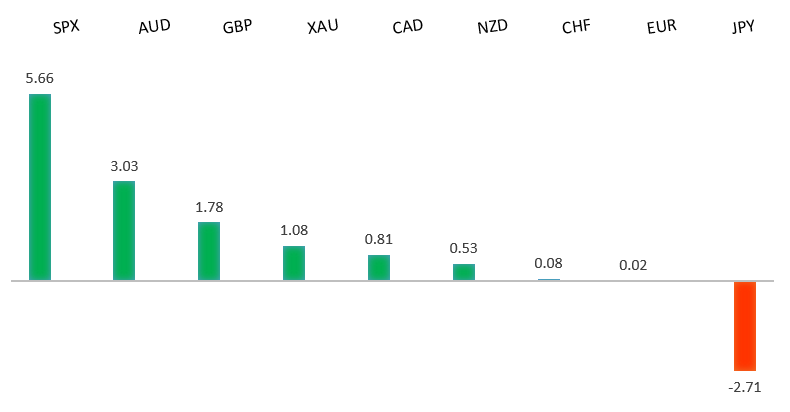

Peformance chart: 30 Day Performance vs. US dollar (%)

Suggested reading

- Why Interest-Rate Hawks May Not Sweep All Before Them in 2022, M. Moss, Bloomberg (January 4, 2022)

- Can the Stock Market's Momentum Continue Into 2022? , J. Horowitz, ACNN (January 2, 2022)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

Setbacks have extended to retest the critical 61.8% fib retrace off the 2020 low to 2021 high move. Technical studies are now tracking in extended territory on the weekly chart, warning of the need for a corrective bounce ahead. Look for the market to hold up on a weekly close basis above the 61.8% fib retrace around 1.1275. Back above 1.1465 strengthens outlook. Weekly close below 1.1275 negates.EURUSD – fundamental overview

The Euro comes into 2022 under pressure on the back of diverging central bank policy outlooks at the Fed and ECB. The ECB is seen by many as being behind the curve, while the surge in virus cases in Europe is not helping matters either. Key standouts on today’s calendar come from German retail sales, German unemployment, UK manufacturing PMI reads, BOE consumer credit, Canada producer prices, Canada manufacturing PMI reads, US ISM manufacturing, and US JOLTs job openings.EURUSD - Technical charts in detail

GBPUSD – technical overview

The market is in a correction phase in the aftermath of the run to fresh multi-month highs earlier this year. At this stage, additional setbacks should be limited to the 1.3000 area ahead of the next major upside extension towards a retest and break of critical resistance in the form of the 2018 high. Back above 1.3608 takes pressure off the downside.GBPUSD – fundamental overview

The Pound has been feeling better about improved economic data and less concerning news around the dangers of the omicron variant. This has resulted in upwardly revised BOE rate hike expectations as the market gets back to focusing on the economy and the uptick in inflation. Key standouts on today’s calendar come from German retail sales, German unemployment, UK manufacturing PMI reads, BOE consumer credit, Canada producer prices, Canada manufacturing PMI reads, US ISM manufacturing, and US JOLTs job openings.USDJPY – technical overview

The longer-term trend is bearish despite the recent run higher. Look for additional upside to be limited, with scope for a topside failure and bearish resumption back down towards the 100.00 area. It would take a clear break back above 116.00 to negate the outlook.USDJPY – fundamental overview

The Yen has been well offered into 2022 on flow from US Dollar demand on diverging Fed/BOJ policy, and flow from an uptick in risk appetite. BoJ Governor Kuroda has said the central bank will only discuss policy normalization once inflation is closer to 2%. Key standouts on today’s calendar come from German retail sales, German unemployment, UK manufacturing PMI reads, BOE consumer credit, Canada producer prices, Canada manufacturing PMI reads, US ISM manufacturing, and US JOLTs job openings.AUDUSD – technical overview

The Australian Dollar has been in the process of a healthy correction following the impressive run towards a retest of the 2018 high in 2021. At this stage, the correction is starting to look stretched and setbacks should be well supported above 0.7000 on a weekly close basis. A weekly close below 0.7000 will force a bearish shift.AUDUSD – fundamental overview

We'vere seeing some demand in recent sessions as risk appetite comes back helped along by China stimulus news as 2021 closed out. But overall, the Australian Dollar is under pressure, mostly on the back of diverging Fed/RBA policy and this latest dump in commodities prices. Key standouts on today’s calendar come from German retail sales, German unemployment, UK manufacturing PMI reads, BOE consumer credit, Canada producer prices, Canada manufacturing PMI reads, US ISM manufacturing, and US JOLTs job openings.USDCAD – technical overview

Finally signs of a major bottom in the works after a severe decline from the 2020 high. A recent weekly close back above 1.2500 encourages the constructive outlook and opens the door for a push back towards next critical resistance in the 1.3000 area. Any setbacks should be well supported into the 1.2200s.USDCAD – fundamental overview

We're seeing some Canadian Dollar demand in recent sessions as risk appetite comes back and oil recovers, but overall, the Canadian Dollar is under pressure into 2022, falling victim to diverging central bank policy and a worsening virus outlook in Canada. Ontario has just hit the panic button, calling for all schools to be taught online. Key standouts on today’s calendar come from German retail sales, German unemployment, UK manufacturing PMI reads, BOE consumer credit, Canada producer prices, Canada manufacturing PMI reads, US ISM manufacturing, and US JOLTs job openings.NZDUSD – technical overview

The market has entered a period of intense correction after running up to a yearly and multi-month high. Back below 0.6700 would suggest a more significant bearish structural shift.NZDUSD – fundamental overview

We're seeing some support in recent sessions as risk appetite comes back, but overall, economic data out of New Zealand has been softer of late, RBNZ rate hike expectations have been scaled back, the phased border reopening has been delayed due to omicron, and risk off flow has soured sentiment. All of this has been behind this latest wave of Kiwi underperformance into 2022. Key standouts on today’s calendar come from German retail sales, German unemployment, UK manufacturing PMI reads, BOE consumer credit, Canada producer prices, Canada manufacturing PMI reads, US ISM manufacturing, and US JOLTs job openings.US SPX 500 – technical overview

Longer-term technical studies are looking quite exhausted and the market is showing signs of wanting to roll over after racing to another record high. At the same time, the latest breakout into the 4800 area introduces the possibility for the next major upside extension towards 5000. At this stage, it will take a break back below 4500 to take the immediate pressure off the topside.US SPX 500 – fundamental overview

We're trading just off fresh record highs, and yet, with so little room for additional central bank accommodation, given an already depressed interest rate environment, the prospect for sustainable runs to the topside on easy money policy incentives and government stimulus, should no longer be as enticing to investors. Meanwhile, ongoing worry associated with coronavirus fallout and risk of rising inflation should weigh more heavily on investor sentiment in Q1 2022.GOLD (SPOT) – technical overview

The 2019 breakout above the 2016 high at 1375 was a significant development, opening the door for fresh record highs and an acceleration beyond the next major psychological barrier at 2000. Setbacks should now be well supported above 1600.GOLD (SPOT) – fundamental overview

The yellow metal continues to be well supported on dips with solid demand from medium and longer-term accounts. These players are more concerned about exhausted monetary policy, extended global equities, and coronavirus fallout. All of this should keep the commodity well supported, with many market participants also fleeing to the hard asset as the grand dichotomy of record high equities and record low yields comes to an unnerving climax.