|

|

16 October 2023 What’s behind the latest bitcoin jump |

| LMAX Digital performance |

|

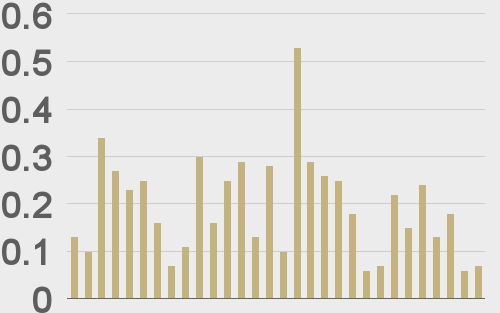

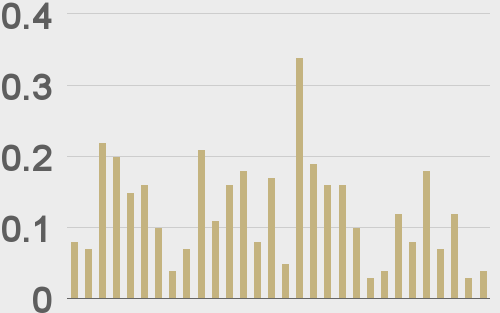

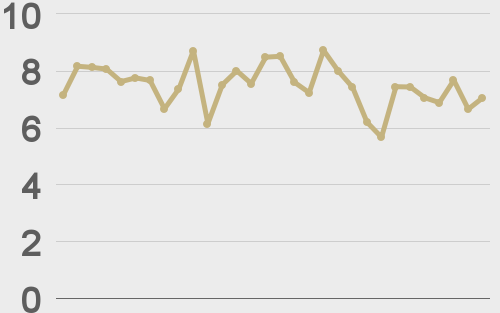

Total notional volume at LMAX Digital cooled off in the previous week. Total notional volume from last Monday through Friday came in at $926 million, 38% lower than the week earlier. Breaking it down per coin, bitcoin volume came in at $565 million in the previous week, 41% lower than the week earlier. Ether volume came in at $263 million, 39% lower than the week earlier. Total notional volume over the past 30 days comes in at $5.9 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,635 and average position size for ether at $2,414. Volatility is moderately higher after recovering from cycle lows in August. We’re looking at average daily ranges in bitcoin and ether of $614 and $40 respectively. |

| Latest industry news |

|

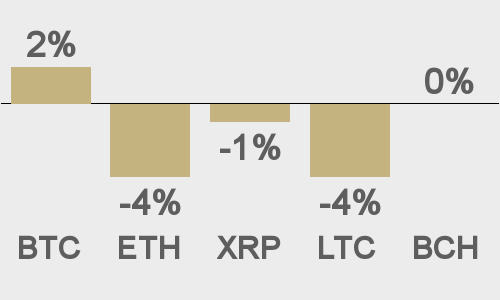

An impressive weekend recovery in the price of bitcoin has become even more impressive as the new week gets going. We believe there are two drivers behind this latest push back to the topside. The first driver comes from all things global macro. There has been an intense pickup in demand for store of value assets in a world where geopolitical tension is on the rise and inflation remains an ongoing concern. We saw the price of gold rocketship higher on Friday because of this, and market participants have been reminded of bitcoin’s own value proposition as an asset with similar properties and even added advantages (easier to hold, faster to move, more secure payment network, more scarce). The second driver is more crypto specific. There has been an overwhelming consensus amongst analysts that a bitcoin spot ETF will get approved between now and January 2024. The fact that the SEC is having more constructive conversations with bitcoin spot ETF applicants has been encouraging, while the SEC’s recent decision against appealing a court ruling in favor of Grayscale only adds to the case that things are moving in a better direction. Of course, an approval of a bitcoin spot ETF will usher in a massive wave of institutional adoption, which in turn, will invite significant upside pressure on the price of bitcoin. We suspect this will have a positive impact on the rest of crypto assets as well, though other cryptocurrencies are expected to underperform bitcoin considering the less certain regulatory outlook for these tokens and the higher correlation with risk sentiment at a time when global markets are under pressure. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

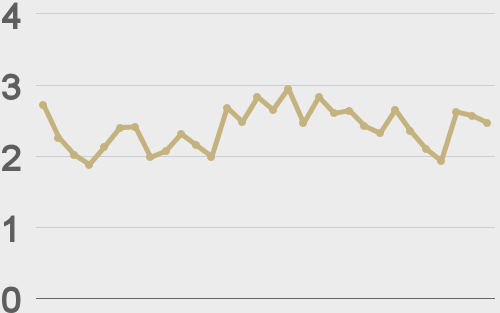

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@markets |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||