|

|

7 March 2023 What lies ahead |

| LMAX Digital performance |

|

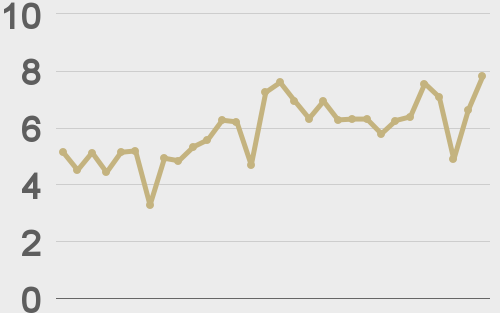

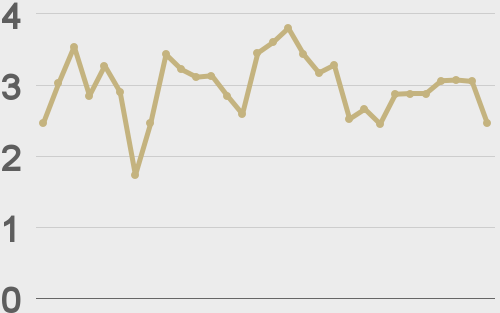

LMAX Digital volumes were off to start the week. Total notional volume for Monday came in at $272 million, 28% below 30-day average volume. Bitcoin volume printed $153 million on Monday, 26% below 30-day average volume. Ether volume came in at $52 million, 50% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $5,992 and average position size for ether at 3,028. Volatility has come off recent highs but still sits well off multi-month lows. We’re looking at average daily ranges in bitcoin and ether of $768 and $60 respectively. |

| Latest industry news |

|

The crypto market continues to be on edge following the latest rumblings in the space around the Silvergate implosion and SEC moves. We suspect these disruptions will continue to pop up in the months ahead, though ultimately, optimism around the longer-term outlook will support prices into dips. Into Tuesday, the crypto market also has to get back to worrying about all things global macro. The Fed Chair will be testifying before Congress and what he has to say could open more movement in prices. Should Powell lean more hawkish, we could see risk markets selling off, which would then potentially expose crypto to downside pressure. On the other hand, given the market is expecting a hawkish Powell, anything that lets these expectations down, will likely inspire a wave of risk on, which could support crypto prices. It’s worth noting, the recent run higher in US equities has helped to mitigate fallout in crypto from Silvergate and SEC moves. Technically speaking, the next big bitcoin level of support to keep an eye on is the February low at $21,365. A break below there would likely expose a deeper drop back towards a retest of $20k. As far as bullish breakouts go, we will need to see bitcoin establish back above $25,200 to suggest the market is looking to make that next big move to the topside. |

| LMAX Digital metrics | ||||

|

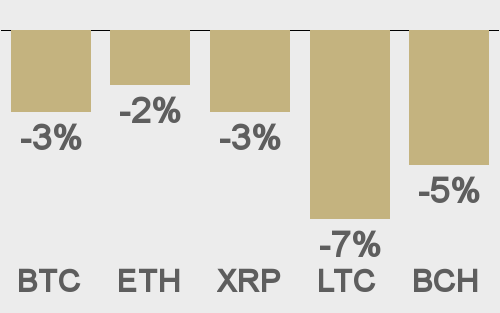

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

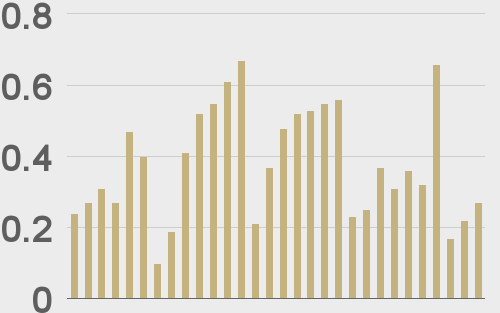

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

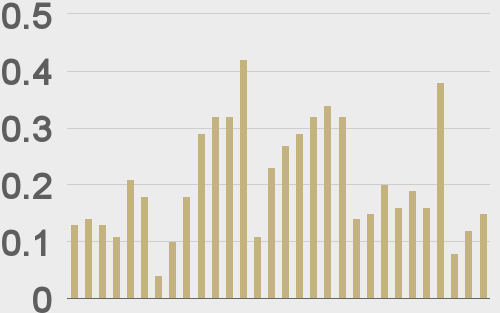

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||