|

|

8 May 2023 Volumes cool off in previous week |

| LMAX Digital performance |

|

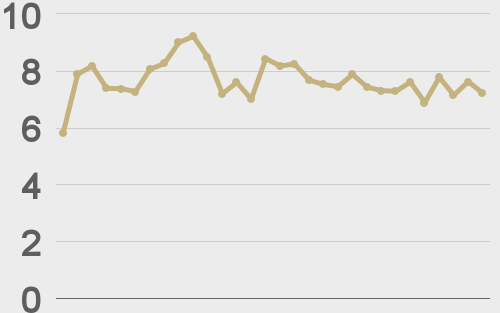

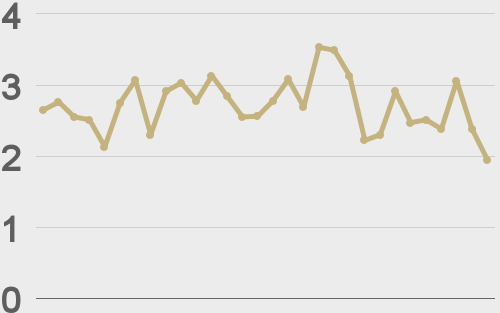

Total notional volume at LMAX Digital cooled off in the previous week. Total notional volume from last Monday through Friday came in at $2.3 billion, 28% lower than the week earlier. Breaking it down per coin, Bitcoin volume came in at $1.45 billion in the previous week, 28% lower than the week earlier. Ether volume came in at $598 million, 30% lower than the week earlier. Total notional volume over the past 30 days comes in at $12.95 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,635 and average position size for ether at $2,780. Volatility has come back down after recently trading up to yearly high levels. We’re looking at average daily ranges in bitcoin and ether of $1,037 and $80 respectively. |

| Latest industry news |

|

We’re coming out of a solid week of performance in cryptocurrencies. Ultimately, gains weren’t anything head turning, but at the same time, both bitcoin and ether closed out the previous week on a positive note. Overall, the structure for both bitcoin and ether remains constructive and we’re in a period of consolidation that is expected to eventually end with a break to the topside, opening the door to a bullish continuation. Last week, crypto got some initial support from a Federal Reserve communication that hinted at the possibility of a pause on rate hikes going forward. This pushed yield differentials out of the US Dollar and back into currencies and cryptocurrencies by extension. Meanwhile, ongoing struggles in the banking sector and uncertainty around the US debt ceiling have further reinforced the compelling value proposition of cryptocurrencies as an alternative investment. Finally, earnings results could also be factoring into support we’ve been seeing in crypto. Last week, Coinbase came out and did a much better job than what the market was pricing. The company produced a loss of just $0.34 per share after the market had been looking for a loss of $1.45 per share. |

| LMAX Digital metrics | ||||

|

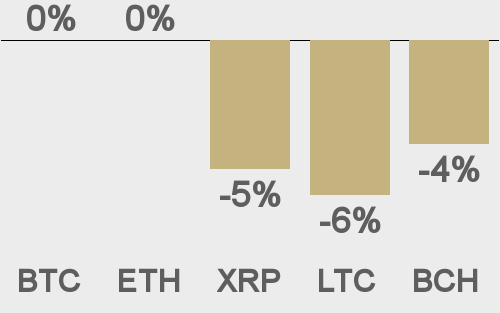

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

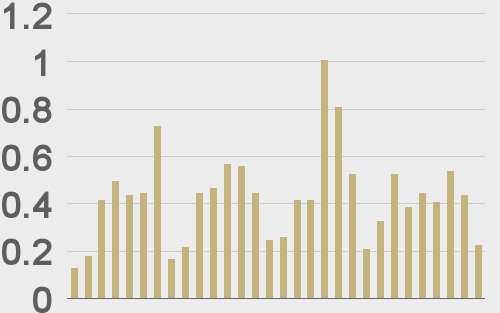

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

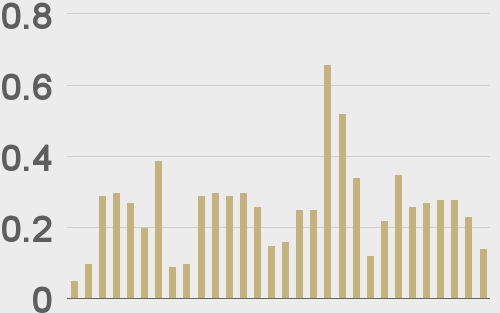

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||