|

|

13 June 2022 US inflation data wreaks havoc on crypto markets |

| LMAX Digital performance |

|

Total notional volume at LMAX Digital was down in the previous week. Total notional volume from Monday through Friday came in at $2.4 billion, 14% lower than the week earlier. Breaking it down per coin, Bitcoin volume came in at $1.6 billion in the previous week, off 22% from a week earlier. Ether volume managed to turn up just a bit, coming in at $487 million, up 5% from the week earlier. Total notional volume over the past 30 days comes in at $13.4 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,529 and average position size for ether at $2,882. Volatility has come back down to yearly low levels after trying to break out in May. We’re looking at average daily ranges in bitcoin and ether of $1,606 and $130 respectively. |

| Latest industry news |

|

As intense as the setbacks have been in the aftermath of last Friday’s US inflation print, we can’t say that this price action wasn’t expected. For many months now we’ve highlighted risks associated with rising inflation and higher interest rates. This harsh reality became even more clear on Friday and we are seeing another round of mass risk liquidation as a consequence. As far as fallout in crypto markets goes, we continue to see great suffering for bitcoin and ether, though on a relative basis, ether is clearly getting hit a lot harder. We think how things play out from here will get even more interesting as far as this dynamic goes, given the fact that there is a very strong argument to be made for bitcoin to outperform traditional assets in current conditions. At this stage however, bitcoin is still viewed by many to be a maturing, emerging market asset, which accounts for the bitcoin weakness during this intense period of risk off. Having said that, we wonder if at a certain point sooner than later, we start to see more committed bitcoin players who understand the longer-term value proposition, stepping in aggressively to take advantage of deeply discounted levels. Technically speaking, the next big level to watch for bitcoin comes in around $20,000, which represents not only a major psychological barrier, but more importantly, a massive previous resistance turned support in the form of the previous record high from 2017. We wouldn’t rule out the possibility for bitcoin to trade even lower now, into the range between the 2019 high and 2017 high, between $14,000 and $20,000. It’s important to highlight downside risk within crypto markets, especially those that are the weakest. It’s also important to highlight downside risk associated with fallout in some of these weakest links. Into Monday, that fallout is associated with crypto lending firm Celsius. The firm has just announced a pause on all withdrawals and transfers in an effort to stop the bleeding. If the firm implodes, it will open the door to contagion across the broader market as the firm is forced to liquidate to meet withdrawals. This will also likely invite more scrutiny from regulatory authorities and in turn, open more negative sentiment in crypto markets. So on net, we see more downside pressure on crypto assets in the days and weeks ahead, before there are any signs of renewed demand. |

| LMAX Digital metrics | ||||

|

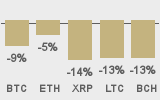

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

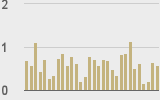

Total volumes last 30 days ($bn) |

||||

|

||||

|

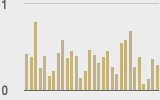

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@nic__carter |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||