|

|

3 January 2024 Seasonality trends and January performance |

| LMAX Digital performance |

|

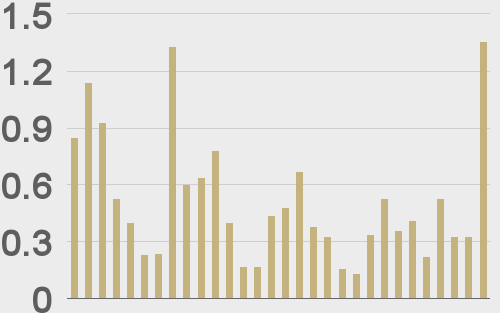

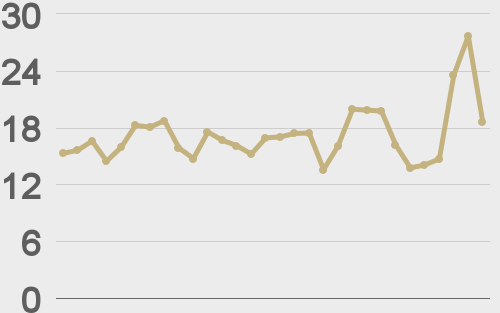

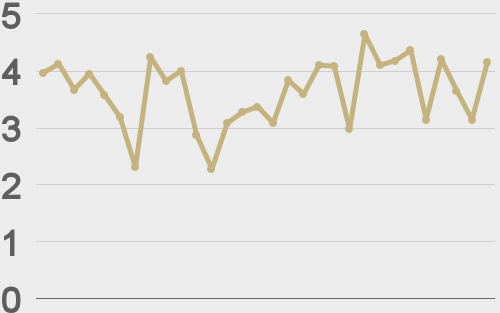

LMAX Digital volumes saw a big jump from a light New Year’s trading day, coming in at the highest levels since December 11, 2023. Total notional volume for Tuesday came in at $1.6 billion, 138% above 30-day average volume. Bitcoin volume printed $1.4 billion on Tuesday, 165% above 30-day average volume. Ether volume came in at $141 million, 53% above 30-day average volume. Average position size has been trending up over the past 30 days. We’re seeing average bitcoin position size at $16,800 and average position size for ether at $3,666. Volatility has been consolidating off multi-month high levels set in December. We’re looking at average daily ranges in bitcoin and ether of $1,433 and $91 respectively. |

| Latest industry news |

|

Bitcoin is off to a fabulous start in 2024, up over 6% in just a few days. Clearly there is plenty of optimism out there with the bitcoin spot ETF approvals around the corner and the halving event on schedule to arrive in Q2 of this year. As January gets rolling, it make sense to take a quick look at seasonality trends for the month considering there is still plenty of road ahead here. Historically, January isn’t one of bitcoin’s best performing months, up only 4.4% on average since 2013. However, when looking at the past four years, three out of four have produced positive returns, with a net average of over 8%. As far as expectations over the short-term go, we still believe there is room for the rally to extend once the ETFs are finally approved. As much as the event has been priced in, considering how much hangs in the balance, there is definitely some money sitting on the sidelines, waiting for an actual confirmation. We anticipate the rally in the immediate aftermath could amount to a move of about 10% over the course of a day or two. At that point, we suspect there could be a period of consolidation and correction before the uptrend resumes for a run back towards and eventually through the record high, perhaps as soon as Q2 of this year. The benefit of ETF access to a new institutional product in an asset that has also proven to be uncorrelated, is a benefit that will unquestionably be taken advantage of, especially considering the fact these institutions will not need to have any direct contact with the underlying asset. |

| LMAX Digital metrics | ||||

|

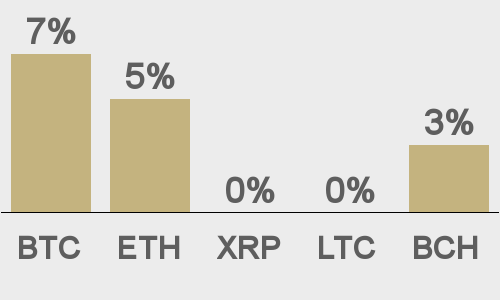

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||