|

|

12 July 2023 Catalysts for renewed volatility |

| LMAX Digital performance |

|

LMAX Digital volumes cooled off on Tuesday after a solid start to the week. Total notional volume for Tuesday came in at $293 million, 17% below 30-day average volume. Bitcoin volume printed $197 million on Tuesday, 7% below 30-day average volume. Ether volume came in at $63 million, 36% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,492 and average position size for ether at 2,692. Volatility has been trending lower in recent days after an impressive run up in June. We’re looking at average daily ranges in bitcoin and ether of $861 and $57 respectively. |

| Latest industry news |

|

We’re into the mid-week and yet, still no major updates on the crypto front. Prices have been confined to some very tight ranges and until we see bitcoin push back above the $31,500 area or fall back below $29,400, we should expect more of the same. As far as catalysts for a breakout in volatility go, we’re looking at two possible candidates, one more imminent than the other. The first catalyst comes from today’s US CPI data, and the second catalyst comes from any news around the approval of a bitcoin ETF. In truth, assessing the direction of bitcoin and the rest of the crypto market in the aftermath of the CPI report isn’t all that easy. Indeed, there have been signs at times of a correlation with global risk sentiment. If this correlation is in play today, any reading from the inflation data that comes in softer than expected, could open the door for a bullish breakout. A softer read would imply a less hawkish Federal Reserve, which would be a comfort to investors. If on the other hand we see inflation data come in on the hot side, it could inspire a wave of risk off flow, which in turn, could weigh on crypto by extension, as market participants look to get out of riskier bets. But we say it’s difficult to assess how crypto will respond because there is a strong argument to be made for bitcoin to want to rally in a risk off situation. After all, this is a limited supply asset that can easily be viewed as a flight to safety, store of value play. As far as the bitcoin ETF applications go, there is plenty of optimism around many of these applications getting approved in the weeks ahead. If this happens, we can expect a major move higher in crypto prices on account of the wave of adoption these approvals will usher in. |

| LMAX Digital metrics | ||||

|

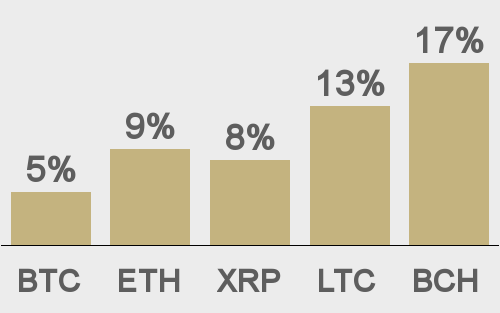

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

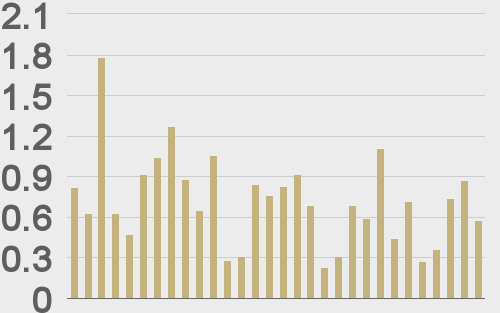

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

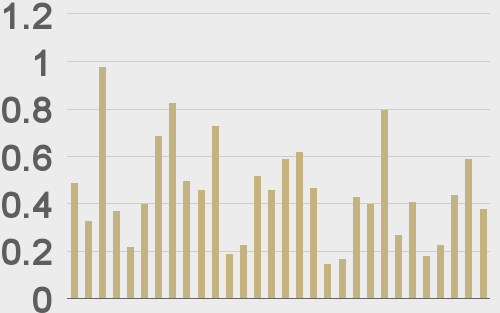

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

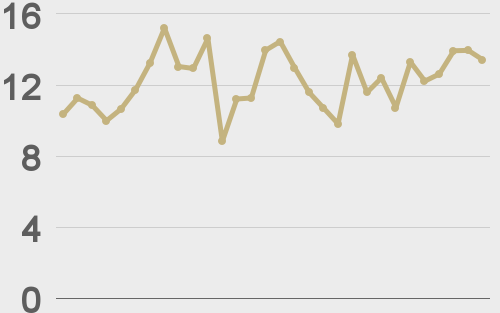

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||