|

|

15 June 2022 Bitcoin versus crypto |

| LMAX Digital performance |

|

LMAX Digital volumes have been impressive this week, showing clear signs of a push back to the topside. Total notional volume for Tuesday came in at $1.39 billion, up 162% from 30-day average volume. Bitcoin volume printed $814 million on Tuesday, 138% above 30-day average volume. Ether volume came in at $455 million, 260% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,375 and average position size for ether at 2,907. There have also been signs of a pickup in volatility in recent days. We’re now looking at average daily ranges in bitcoin and ether of $1,829 and $141 respectively. |

| Latest industry news |

|

Most of the downside pressure in crypto assets is unquestionably coming from the downturn in global risk sentiment and fallout in US and global equities. This is the first time a crypto pullback is being accompanied by a legitimate bear market in stocks and this is only adding to the intensity of the situation. Of course, in periods of weakness, the most vulnerable of operations are exposed. Absence of proper regulation in the crypto space makes this perhaps even scarier, with shops that have overextended themselves now in big trouble and at risk for complete insolvency. We’ve already seen fallout from Terra in the previous month. Now it’s Celsius and 3AC that are going through the ringer. And so, there is an element of added downside pressure on the space because of this. At the same time, it’s very important to be able to distinguish between downside pressure in the web3, decentralized finance space, versus downside pressure in bitcoin. While the downside pressure in the web3, decentralized finance space is very much understandable, downside pressure in bitcoin is not as straightforward. Indeed, to many out there, bitcoin is still considered to be an emerging market, still maturing, with a lot of uncertainty around it. At the same time, bitcoin is a currency, store of value, and flight to safety asset given all of its amazing properties. Because of this, we expect bitcoin to have a much easier time finding support down into this dip, than alternative cryptocurrencies, especially if risk off in global markets persists. Technically speaking, we’ve highlighted the $14,000 to $20,000 area as a formidable zone for medium and longer-term players who recognize bitcoin’s value proposition, to step in and take advantage of extremely discounted prices. For today, a lot of the focus will be on the Fed decision. If the central bank gives off a message of needing to be more aggressive with rate hikes, it will likely add to downside pressure on risk assets and in turn weigh some more on crypto markets. Again, we see bitcoin outperforming other currencies in such an outcome. If on the other hand the Fed is less aggressive in its communication, it could inspire a welcome recovery in the market. |

| LMAX Digital metrics | ||||

|

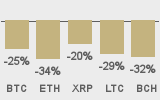

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

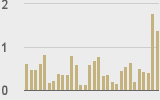

Total volumes last 30 days ($bn) |

||||

|

||||

|

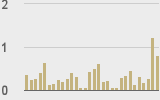

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||