|

|

27 September 2023 Bitcoin September performance in perspective |

| LMAX Digital performance |

|

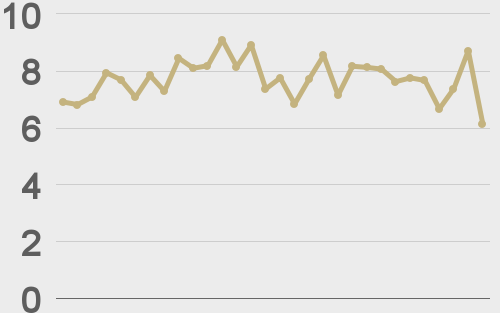

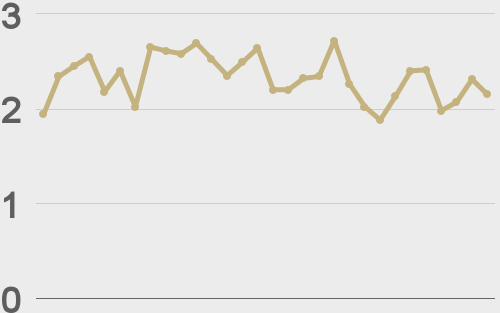

LMAX Digital volumes cooled off on Tuesday, and understandably so given some very tight ranges. Total notional volume for Tuesday came in at $155 million, 23% below 30-day average volume. Bitcoin volume printed $108 million on Tuesday, 19% below 30-day average volume. Ether volume came in at $33 million, 34% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,673 and average position size for ether at $2,320. Volatility is back to trending lower, towards August multi-month low levels. We’re looking at average daily ranges in bitcoin and ether of $564 and $36 respectively. |

| Latest industry news |

|

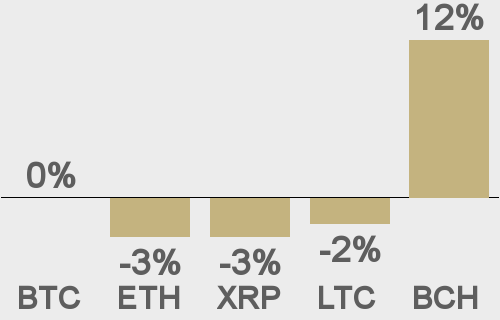

All things considered, bitcoin has been holding up exceptionally well in its worst performing month, and at a time when global markets are under intense pressure. If we look at 30-day performance versus the US Dollar across all major asset classes, bitcoin stands out as an outperformer, up nearly 1% over this time frame, as compared to the S&P500, which is down around 3%. We believe there are many market participants out there who both recognize what has yet to be priced into bitcoin as an emerging asset, and what should be priced into bitcoin as an attractive flight to quality play. We also see bitcoin benefiting from a regulatory climate which involves far more uncertainty around other crypto assets. This explains bitcoin’s outperformance against ether. Of course, there is still downside pressure that needs to be considered at a time when yield differentials are moving so aggressively in the US Dollar’s favor, and at a time where global investors are liquidating equity market exposure. But ultimately, we continue to see bitcoin exceptionally well supported on any dips below $25k, with the next big push coming to the upside, back above the yearly high and eventually towards a retest of the record high. As far as the latest industry developments go, following in the footsteps of Santander, Barclays, and NatWest, Chase Bank is implementing a ban on crypto-related payments via debit cards and bank transfers for its UK customers. Meanwhile, MoneyGram has announced plans to launch a non-custodial digital wallet in the first quarter of 2024. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

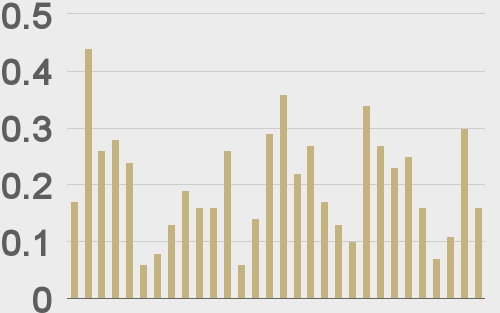

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

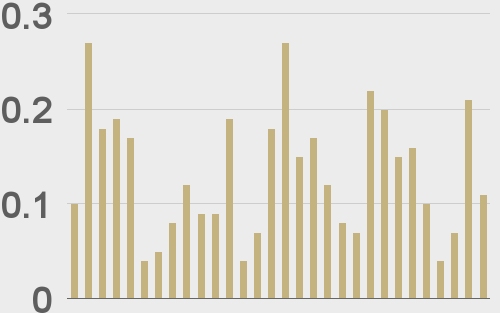

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||