|

|

9 January 2024 Bitcoin extends run in anticipation of SEC approvals |

| LMAX Digital performance |

|

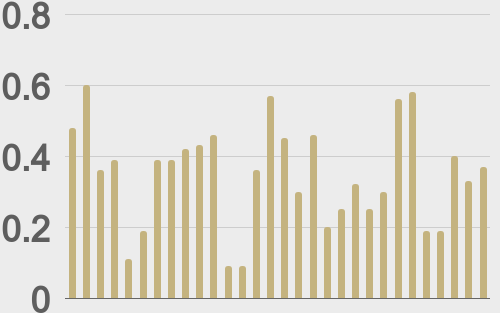

LMAX Digital volumes were impressive on Monday. Total notional volume for Monday came in at $1.4 billion, 96% above 30-day average volume. Bitcoin volume printed $1.1 billion on Monday, 97% above 30-day average volume. Ether volume came in at $131 million, 42% above 30-day average volume. Average position size over the past 30 days has been trending up. We’re seeing average bitcoin position size at $17,535 and average position size for ether at $3,670. Volatility is tracking at multi-month highs. We’re looking at average daily ranges in bitcoin and ether of $1,772 and $101 respectively. |

| Latest industry news |

|

A period of multi-session consolidation has come to an end, with bitcoin extending its run and once again pushing to fresh multi-month highs. Bitcoin is trading at its highest level since April 2022 and the price action suggests we should soon see a retest of the major psychological barrier at $50k. There is no denying where all of this demand is coming from. The market has been getting more hints at the imminent SEC approval of the bitcoin spot ETFs, which could come as soon as the next 24 hours or so. On Monday, we heard from Jay Clayton, former SEC Chair, who said the bitcoin spot ETF was inevitable. And perhaps more importantly, acting SEC Chair Gary Gensler put out a Twitter thread highlighting things to keep in mind when investing in crypto. Fee competition amongst the ETF issuers has now become an interesting topic of conversation, with some of the issuers slashing rates dramatically, while others hold steady, betting on their long standing presence in the space and pre-existing competitive edge. It shouldn’t come as a surprise to see the price of eth lagging. At the same time, we believe signs of the next meaningful bullish push within the space should come from eth pushing to its own multi-month high. But we suspect a rally in the aftermath of SEC confirmation could very well be the catalyst that sparks the breakout in eth. Capital flow updates have also been a positive for the space. We’ve seen an uptick in capital flows as 2024 gets going. Digital asset investment products saw $151 million of inflows last week, led by bitcoin product inflows of $113 million. |

| LMAX Digital metrics | ||||

|

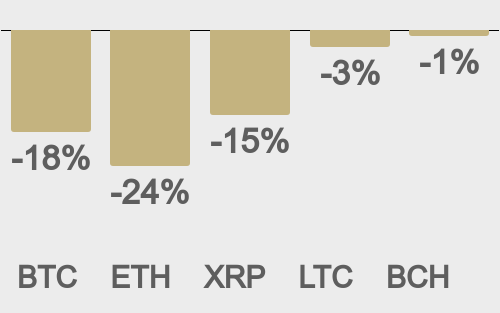

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

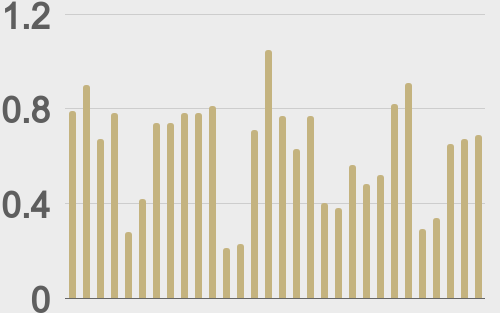

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

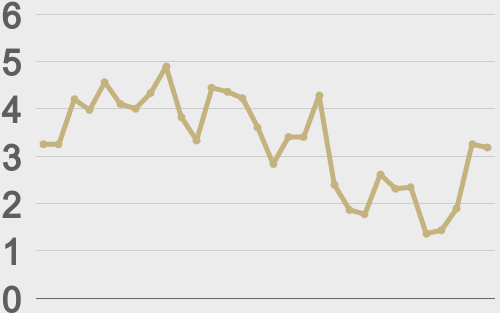

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||