|

|

19 January 2023 Another impressive day of volume |

| LMAX Digital performance |

|

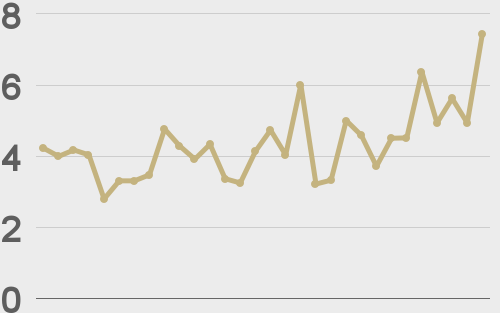

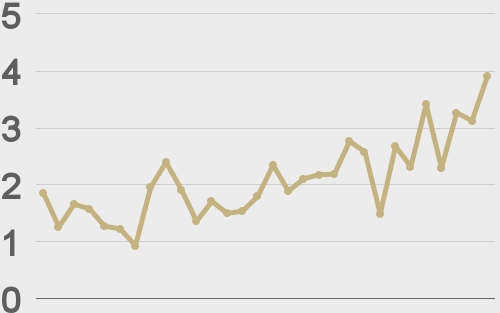

LMAX Digital volumes have been exceptionally healthy to start the year and Wednesday volume was no exception, putting in the second highest volume levels since January 1. Total notional volume for Wednesday came in at $707 million, 168% above 30-day average volume. Bitcoin volume printed $391 million on Wednesday, 169% above 30-day average volume. Ether volume came in at $135 million, 116% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $4,675 and average position size for ether at 2,267. Volatility is finally showing signs of turning up from multi-month lows. We’re looking at average daily ranges in bitcoin and ether of $582 and $56 respectively. |

| Latest industry news |

|

We’ve been warning this week about the risk for a pullback and consolidation in crypto assets. On Wednesday, the market started to roll over. Fundamentally, the pullback comes from a wave of bad news in global markets and some not so great news on the crypto front. As far as global markets go, risk off flow has taken control on the back of soft US economic data and unimpressive earnings results. And on the crypto front, the news of Genesis heading towards Chapter 11 has not helped. There had been some added stress around news the US Department of Justice would be making a statement regarding crypto. But this stress was relieved when it was discovered the announcement was about enforcement action against a Russian exchange. Technically speaking, we’ve highlighted the need for a pullback to allow for some severely overbought readings on the daily chart to unwind. It’s also worth noting, as per our chart analysis today, that the big picture is still not all that bullish. Ultimately, a break in the price of bitcoin back above the August 2022 high at $25,220 would be required to truly encourage the prospect for the start to the next meaningful bullish run. |

| LMAX Digital metrics | ||||

|

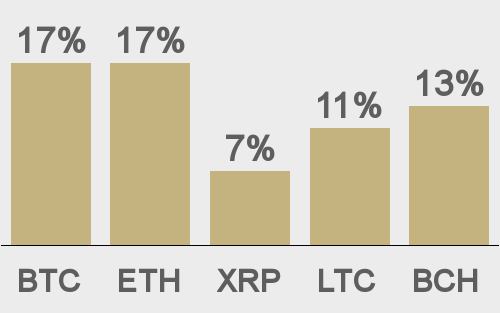

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

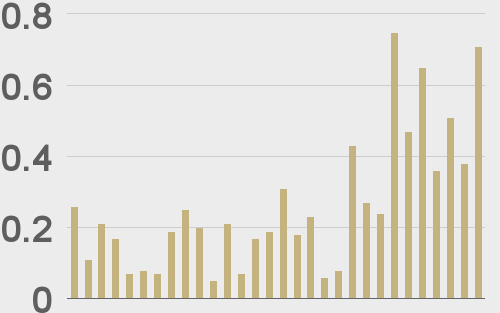

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

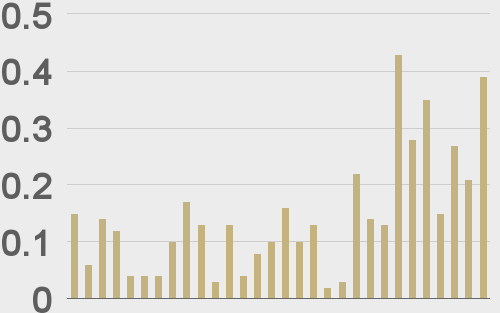

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||