|

|

22 May 2024 Bitcoin has $100k barrier in sight |

| LMAX Digital performance |

|

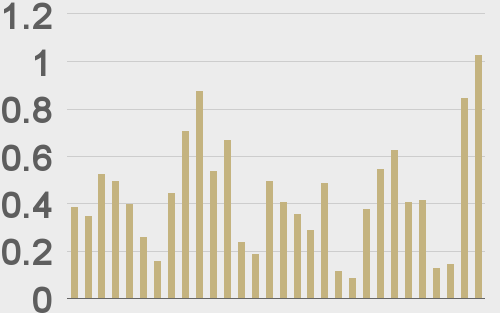

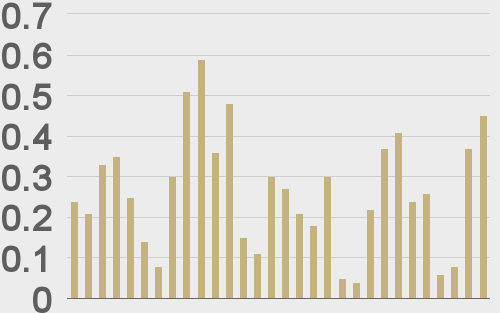

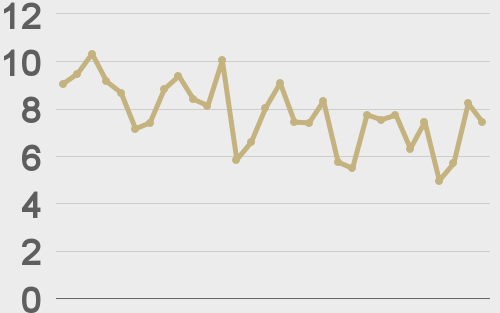

LMAX Digital volumes crossed back above the $1 billion mark for the first time since April 14. Total notional volume for Tuesday came in at $1.03 billion, 137% above 30-day average volume. Bitcoin volume printed $448 million, 71% above 30-day average volume. Ether volume came in at $449 million, 301% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,087 and average position size for ether at $3,549. Market volatility has been picking back up in recent sessions after trending lower since March. We’re looking at average daily ranges in bitcoin and ether of $2,674 and $171 respectively. |

| Latest industry news |

|

Crypto market momentum continues to run strong into the mid-week on the back of the latest optimism around the overall regulatory climate in the US and the possibility for a more imminent SEC approval of the spot ETH ETFs. The SEC’s request for exchanges to update 19b-4 filings has dramatically increased the probability for a sooner than later spot ETH ETF approval. This comes on the heels of last week’s US Senate vote to repeal the SEC’s Staff Accounting Bulletin (SAB 121) – which may have forced a turnaround in the SEC’s thinking after the vote reflected a clearer, bipartisan support for crypto adoption and a more crypto friendly regulatory environment. The approval of spot ETH ETFs will be a significant moment for crypto overall, as it will send a message of wider acceptance and recognition in the potential of crypto as a multi-faceted, multi-dimensional asset class. Recent data shows the Dollar value locked in active ETH futures contracts climbing 25% to a record print in excess of $14 billion over the past 24 hours. The news of Donald Trump accepting crypto for campaign donations has generated added buzz and provides even more evidence of crypto going mainstream in 2024. Technically speaking, bitcoin is inching closer to retesting the record high from March. As per today’s chart insights, a break above the high will confirm a fresh higher low and open the next measured move extension target just over $91k. |

| LMAX Digital metrics | ||||

|

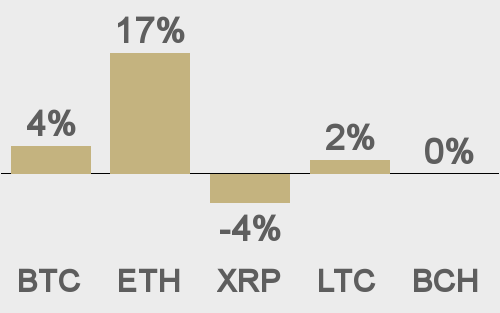

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

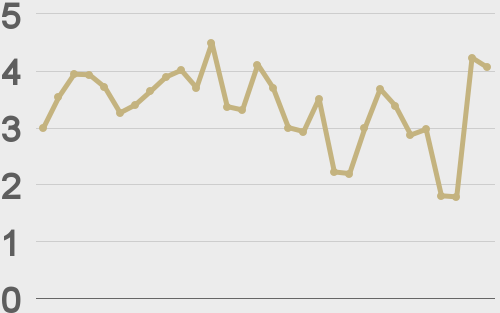

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@Blockworks_ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||