Next 24 hours: Market looking ahead to US inflation data

Today’s report: Tariff talk invites more US Dollar demand

Friday’s run of stronger US data and worry around the threat of US tariffs on China have been behind a lot of the latest run of price action which has leaned in the US Dollar’s direction.

Wake-up call

- ECB Minutes

- Pound outperforms

- BOJ trims

- NAB survey

- jobs overshadowed

- NZDUSD RBNZ expectations survey shows cooling

- inflation outlook

- Macro themes

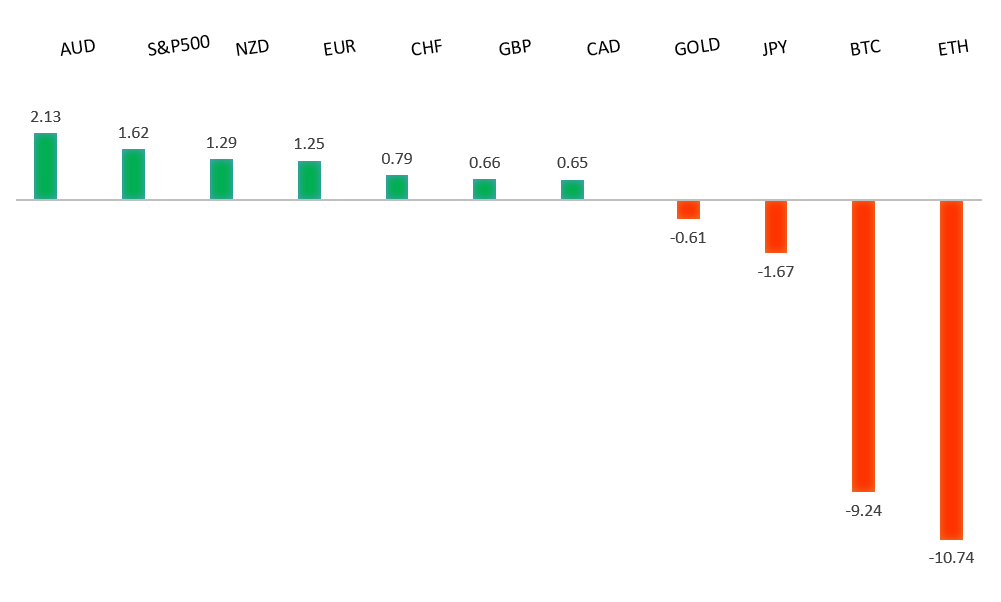

Peformance chart: 30-Day Performance vs. US dollar (%)

Suggested reading

- Could Solar Radiation Management Cool the Planet?, A. Williams, Financial Times (May 13, 2024)

- Financial Fraud Lurks On TikTok, B. Ritholtz, The Big Picture (May 9, 2024)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The Euro has been in a multi-month consolidation since bottoming out in 2022. Setbacks have since been exceptionally well supported on dips below 1.0500, with a higher platform sought out ahead of the next major upside extension. Look for a push through the 2023 high at 1.1276 to strengthen the constructive outlook and extend the recovery run towards 1.2000. Only back below 1.0400 negates.EURUSD – fundamental overview

The Euro cooled off on Friday after the ECB Minutes were out and all but confirmed a June rate cut. Key standouts on Monday’s calendar come from Canada building permits, the German current account, US consumer inflation expectations, and Fed speak.EURUSD - Technical charts in detail

GBPUSD – technical overview

Signs have emerged of the market wanting to put in a longer-term base after collapsing to a record low in September 2022. The latest push to a fresh 2024 high beyond 1.2830 confirms the outlook and opens the door for the next major upside extension towards the 2023 high at 1.3143. Any setbacks should now be well supported ahead of 1.2000.GBPUSD – fundamental overview

There was no struggling to reconcile the latest run of outperformance in the Pound, which was well bid on the back of surprisingly solid UK GDP data and well above forecast UK industrial production. Key standouts on Monday’s calendar come from Canada building permits, the German current account, US consumer inflation expectations, and Fed speak.USDJPY – technical overview

The market remains confined to a strong uptrend, most recently extending to a multi-year high through 160.00. Key support comes in at 151.95, with only a weekly close below to delay the constructive outlook.USDJPY – fundamental overview

A trimming in BOJ bond buying has slowed the pace of Yen declines on Monday. But overall, monetary policy divergence continues to invite plenty of Yen selling into any rallies, even amidst threats of official action. Key standouts on Monday’s calendar come from Canada building permits, the German current account, US consumer inflation expectations, and Fed speak.AUDUSD – technical overview

There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.6200 would give reason for rethink. Back above 0.6900 will take the big picture pressure off the downside and strengthen case for a bottom.AUDUSD – fundamental overview

Aussie Treasurer Chalmers was out on Sunday talking about the possibility for further energy bill relief. On the data front, the NAB monthly business survey for April showed conditions easing from the previous month. The data continues to show a slowing in activity and an easing of price pressures within the economy. Over the weekend, China released a round of mixed inflation data. Key standouts on Monday’s calendar come from Canada building permits, the German current account, US consumer inflation expectations, and Fed speak.USDCAD – technical overview

Above 1.3000 signals an end to a period of longer-term bearish consolidation and suggests the market is in the process of carving out a more significant longer-term base. Next key resistance now comes in up into the 1.4000 area. Setbacks should be very well supported down into the 1.3000 area.USDCAD – fundamental overview

Clearly, the Canadian Dollar is struggling with downside pressure in the price of oil. On Friday, the Canada employment report came out much stronger than forecast - to the point where odds for a June Bank of Canada rate cut dropped to 40% from 70% earlier on in the previous week. And yet, even with the strong data and reduced BoC cut odds, the Canadian Dollar couldn't rally much, seemingly on concerns around the weakness in the price of oil. Key standouts on Monday’s calendar come from Canada building permits, the German current account, US consumer inflation expectations, and Fed speak.NZDUSD – technical overview

Overall pressure remains on the downside with the market continuing to stall out on runs up into the 0.6500 area. At the same time, there are some signs of the market wanting to put in a longer-term base. Ultimately, a break back above 0.6500 would be required to take the medium-term pressure off the downside and encourage this prospect. A monthly close below 0.5800 will intensify bearish price action.NZDUSD – fundamental overview

The latest RBNZ survey of expectations shows a continued, sharp moderation in near-term inflation expectations, which should take pressure of the central bank from needing to lean too hawkish with its policy outlook. At the same time, food prices are back on the rise, which could keep the market from getting overly optimistic about a less hawkish central bank. Other data out on Monday includes performance of services which was virtually unchanged. Key standouts on Monday’s calendar come from Canada building permits, the German current account, US consumer inflation expectations, and Fed speak.US SPX 500 – technical overview

Longer-term technical studies continue to look quite extended after pushing to fresh record highs, begging for a deeper correction ahead. Look for rallies to be well capped in favor of lower tops and lower lows. Next key support comes in at 4921.US SPX 500 – fundamental overview

Though we have seen a healthy adjustment of investor expectations towards the amount of rate cuts in 2024, the market still hopes policy will end up erring more towards the investor friendly, accommodative side of things. This bet has kept stocks well bid into dips and consistently pushing record highs. The trouble right now is that inflation has been showing signs of ticking back up, all while the market contends with additional uncertainty around geopolitical risk.GOLD (SPOT) – technical overview

The 2019 breakout above the 2016 high at 1375 was a significant development, opening the door for fresh record highs. Setbacks should now be well supported above 1900 on a monthly close basis ahead of the next major upside extension towards 2500.GOLD (SPOT) – fundamental overview

The yellow metal has pushed record highs in 2024 with solid demand from medium and longer-term accounts. These players are more concerned about inflation, geopolitical risk and a less upbeat global growth outlook. All of this should keep the commodity well supported, with many market participants also fleeing to the hard asset as the grand dichotomy of record high equities and record low yields comes to an end.