|

|

30 January 2024 Why bitcoin is looking forward to February |

| LMAX Digital performance |

|

LMAX Digital volumes got off to a quiet start on Monday. Total notional volume for Monday came in at $271 million, 64% below 30-day average volume. Bitcoin volume printed $150 million on Monday, 74% below 30-day average volume. Ether volume came in at $73 million, 37% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $14,584 and average position size for ether at $3,509. Volatility has cooled off from multi-month highs set earlier in January. We’re looking at average daily ranges in bitcoin and ether of $1,581 and $95 respectively. |

| Latest industry news |

|

There has definitely been a clear sign of GBTC outflows slowing down in recent days, something we had talked a lot about when trying to make sense of some of the bitcoin selling in the aftermath of the SEC spot bitcoin ETF approvals. And now that this selling looks to be mostly out of the way, the focus can get back to what should be healthy inflows into these new products over the coming weeks and months. When looking at performance in the all other ETFs excluding Grayscale, things have been moving in the right direction, with inflows seen across the board led by the BlackRock ETF and Fidelity ETF. We’re getting ready to close the door on a month of January that delivered as per cyclical analysis that was pointing towards a month of positive performance. As of the time of this update on Tuesday morning, bitcoin is +2.68% for January, pretty much on point with 8-year performance for the month which comes in at 2.64%. Looking ahead, February has been a net positive month for bitcoin performance as well, which sets the stage for another run higher in the weeks ahead. Since 2016, bitcoin has been up an average of 2.56% in February. Technically speaking, the outlook remains highly constructive while bitcoin holds above $40k on a weekly close basis. This keeps the market looking higher for that next big break above the psychological barrier at $50k. Fundamentally, a lot of the attention in the sessions ahead will be around the Fed decision and which way the central bank leans. Bitcoin has been less correlated to global risk sentiment in recent months, though the event risk could certainly inspire some volatility. |

| LMAX Digital metrics | ||||

|

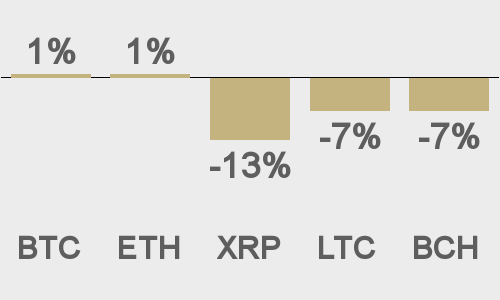

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

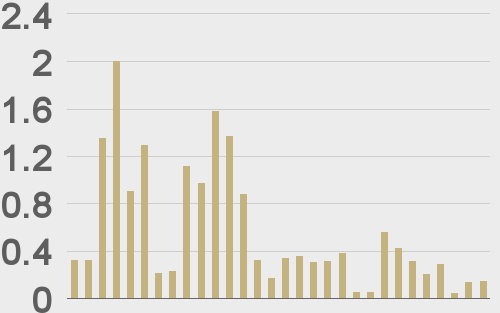

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

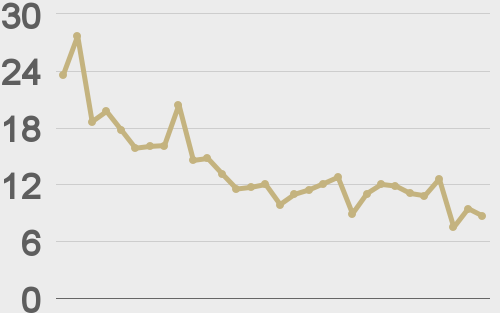

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||