Next 24 hours: Pausing for a little breather

Today’s report: Looking good from all sides

The latest wave of upbeat sentiment in global markets has come from the combination of expectations inflation is peaking in the US, enthusiasm around the China reopening, and relief out of Europe that many major banks now see the Eurozone economy avoiding a winter recession.

Wake-up call

- EZ IP

- UK GDP

- policy tweaks

- China reopening

- Commodities surge

- against peers

- Inflation headache

- Dealers report

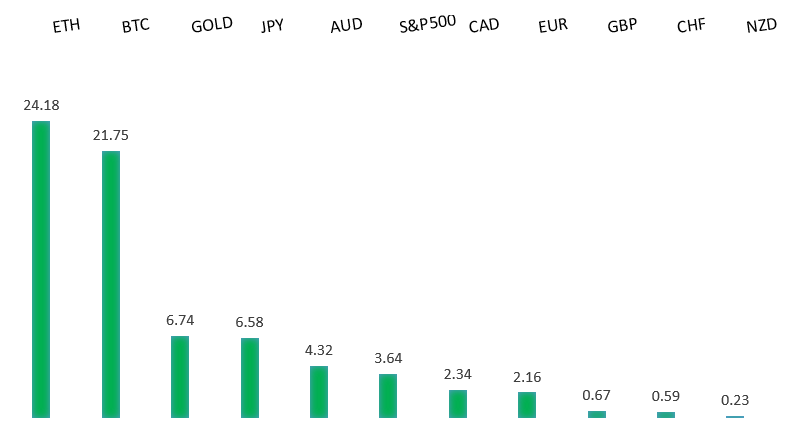

Peformance chart: 30 Day Performance vs. US dollar (%)

Suggested reading

- Hold the Champagne (Brunch). Egg-flation Isn’t Over, or Easy, J. Authers, Bloomberg (January 13, 2023)

- Fusion Power: How Close Are We?, S. Mundy, Financial Times (January 16, 2023)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The Euro recovery has finally run back above meaningful previous support turned resistance at 1.0635. The December close above this level further encourages the recovery outlook and makes a stronger case for the formation of a longer-term bottom. Any setbacks should now be well supported ahead of 1.0300. Next major resistance at 1.1000.EURUSD – fundamental overview

The Euro got another push to the topside on the back of solid EZ industrial production and another major bank (Deutsche Bank) coming out with calls that Europe will avoid a winter recession. Key standouts on Monday’s calendar come from German wholesale prices and Canada manufacturing sales. US markets will be trading lighter on account of the MLK Day holiday.EURUSD - Technical charts in detail

GBPUSD – technical overview

Signs have emerged of the market wanting to put in a longer-term base after collapsing to a record low in September. The latest weekly close back above the September high at 1.1739 strengthens this prospect. Any setbacks should now be well supported ahead of 1.1500. Next key resistance comes in at 1.2668.GBPUSD – fundamental overview

The Pound got a nice boost into the end of last week after UK GDP came in better than expected. At the same time, some of the momentum was taken away on softer industrial production and manufacturing production prints. Key standouts on Monday’s calendar come from German wholesale prices and Canada manufacturing sales. US markets will be trading lighter on account of the MLK Day holiday.USDJPY – technical overview

The major pair has been in the throes of a long overdue correction that was waiting to play out after a parabolic run to the topside to multi-year highs. At this stage, the correction could be getting close to having played out fully, with the market finally approaching critical previous resistance turned support in the 125.00 area.USDJPY – fundamental overview

The Yen rally has extended into the new week as benchmark JGB yields extend further from the policy cap. There has been increasing speculation around further policy adjustment from the BOJ at this week's meeting. Key standouts on Monday’s calendar come from German wholesale prices and Canada manufacturing sales. US markets will be trading lighter on account of the MLK Day holiday.AUDUSD – technical overview

There are signs of the potential formation of a longer-term base following the recent surge back above 0.6500. The recent weekly close back above previous support now turned resistance at 0.6682 strengthens the outlook for a bullish structural shift. Next key resistance comes in at 0.7137.AUDUSD – fundamental overview

The Australian Dollar has surged to its highest level since November on the back of the China reopening trade, metals rally, and broad based pickup in investor sentiment. Key standouts on Monday’s calendar come from German wholesale prices and Canada manufacturing sales. US markets will be trading lighter on account of the MLK Day holiday.USDCAD – technical overview

A recent surge back above 1.3000 signals an end to a period of bearish consolidation and suggests the market is in the process of carving out a more significant longer-term base. Next key resistance now comes in up into the 1.4000 area. Setbacks should be very well supported down into the 1.3000 area.USDCAD – fundamental overview

The Canadian Dollar has been better bid on broad based US Dollar weakness, commodities strength, and risk on flow. Key standouts on Monday’s calendar come from German wholesale prices and Canada manufacturing sales. US markets will be trading lighter on account of the MLK Day holiday.NZDUSD – technical overview

Overall pressure remains on the downside with risk for the current recovery rally to stall out and form a lower top for the next major downside extension. A break back above 0.6577 would be required to take the immediate pressure off the downside.NZDUSD – fundamental overview

Despite gains against the US Dollar in recent sessions, the Kiwi rate has underperformed against its peers on the back of a sharp decline in housing data, a soft commodities price index, and fresh doubts about just how much the RBNZ will need to shift to a less hawkish policy stance. Key standouts on Monday’s calendar come from German wholesale prices and Canada manufacturing sales. US markets will be trading lighter on account of the MLK Day holiday.US SPX 500 – technical overview

Longer-term technical studies are in the process of unwinding from extended readings off record highs. Look for rallies to be well capped in favor of lower tops and lower lows. A monthly close back above 4300 will be required at a minimum to take the immediate pressure off the downside. Next major support comes in at 3492.US SPX 500 – fundamental overview

We've finally reached a point in the cycle where the Fed recognizes unanchored inflation expectations pose a greater downside risk than over-tightening. This is significant, as it means less investor friendly monetary policy that risks potential recession in the months ahead. Overall, we expect inflation to continue to be a problem in H1 2023 that results in downside pressure into rallies.GOLD (SPOT) – technical overview

The 2019 breakout above the 2016 high at 1375 was a significant development, opening the door for fresh record highs. Setbacks should now be well supported above 1600 on a monthly close basis ahead of the next major upside extension. The recent break back above 1808 strengthens the bullish outlook. Next major resistance comes in at 2000.GOLD (SPOT) – fundamental overview

The yellow metal continues to be well supported on dips with solid demand from medium and longer-term accounts. These players are more concerned about inflation risk and a less upbeat global growth outlook. All of this should keep the commodity well supported, with many market participants also fleeing to the hard asset as the grand dichotomy of record high equities and record low yields comes to an unnerving climax.