|

|

14 November 2022 Tough conditions, healthy volume |

| LMAX Digital performance |

|

Total notional volume at LMAX Digital shot up in a big way in the previous week. Total notional volume from last Monday through Friday came in at $5.4 billion, 158% higher than the week earlier. Breaking it down per coin, Bitcoin volume came in at $3.3 billion in the previous week, up 210% from a week earlier. Ether volume came in at $1.6 billion, 100% higher from the week earlier. Total notional volume over the past 30 days comes in at $14.1 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $6,599 and average position size for ether at $2,851. Volatility is finally picking up off yearly and multi-month lows. We’re looking at average daily ranges in bitcoin and ether of $1,026 and $108 respectively. |

| Latest industry news |

|

Last week was a big mess in crypto markets on account of the FTX implosion, and now this week, we’ll have to see just how much contagion there is around the event. The market will be looking for more detail and clarity to get a better handle on the situation. We have seen some demand into the latest dip as the market pauses for a breather, but at this stage, there will need to be a whole lot more in the way of reassuring signs for the market to want to start aggressively buying again. Calls for added regulation have ramped up and this too will be something to watch in the days and weeks ahead. The crypto market has been waiting for more regulatory clarity and the FTX blowup should help to accelerate the process. But again, right now, it’s all about waiting for the dust to settle, as many out there believe there will be more chips to fall as a ripple effect takes hold. Technically speaking, the focus is now on the possibility for deeper setbacks in the price of bitcoin to $10k. We will need to see a break back above $21,500 at a minimum to suggest the market could be feeling a little better, or at least to eliminate immediate downside pressure risk. |

| LMAX Digital metrics | ||||

|

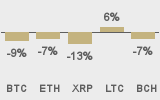

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

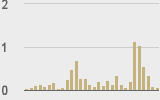

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||