Today’s report: A new type of communication

There has been a trend in recent weeks of central banks delivering aggressive rate hikes accompanied by offsetting downbeat forecasts and more dovish leanings communications. But it seems this is what investors want to hear right now.

Wake-up call

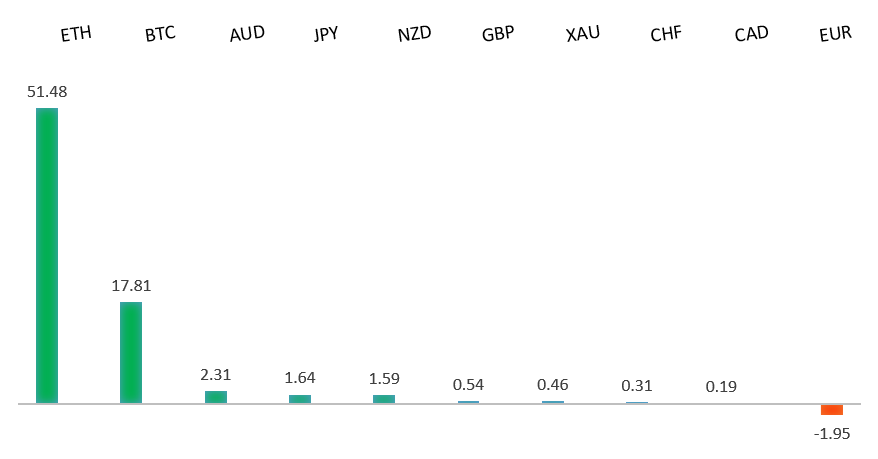

Peformance chart: 30 Day Performance vs. US dollar (%)

Suggested reading

- This $200 Billion Bubble Stock Is No GameStop, M. Brooker, Bloomberg (August 4, 2022)

- De Niro and Nobu: The Origin Story, N. Blasina, FT (August 3, 2022)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The market has come under intense pressure in recent months, with setbacks accelerating below the critical multi-year low from 2017 at 1.0340. This sets up a test of monumental support in the form of parity. At the same time, technical studies are tracking in oversold territory, suggesting additional setbacks should be limited. Back above 1.0500 would be required to take the immediate pressure off the downside.EURUSD – fundamental overview

The Euro was higher on Thursday, helped along by better than expected German factory orders, comments from ECB Kazaks that the central bank should continue to hike rates, and broad based risk on flow. Key standouts on Friday’s calendar come from the RBA SOMP, German industrial production, monthly employment reports out of Canada and the US, and Canada Ivey PMIs.EURUSD - Technical charts in detail

GBPUSD – technical overview

The market continues to be exceptionally well supported on dips below 1.2000. Unless we see a monthly close below 1.2000, we expect this to continue to be the case. Look for this latest break back above 1.2200 to strengthen the case for the establishment of a meaningful base.GBPUSD – fundamental overview

The BOE went ahead and raised rates by 50 basis points as widely expected. This was the largest rate hike for the central bank since 1995. The decision was accompanied by a downbeat communication, which initially weighed on the Pound, though the currency rallied back on broad based risk on flow and US Dollar selling. Key standouts on Friday’s calendar come from the RBA SOMP, German industrial production, monthly employment reports out of Canada and the US, and Canada Ivey PMIs.USDJPY – technical overview

Technical studies are in the process of unwinding, with scope for additional correction in the days and weeks ahead. Look for additional upside from here to be well capped. Next key support comes in at 130.00.USDJPY – fundamental overview

The Yen was back on the bid in Thursday trade, though the price action was mild. It seems the market was buying Yen on flight to safety bids stemming from geopolitical concerns. Meanwhile, senior government official Michio Saito, known as Mr. JGB, said investors should start preparing for a return to normal Japanese bond trading as the BOJ will one day ease up on debt purchases. Key standouts on Friday’s calendar come from the RBA SOMP, German industrial production, monthly employment reports out of Canada and the US, and Canada Ivey PMIs.AUDUSD – technical overview

Overall pressure remains on the downside and conditions remain quite choppy. A break back above 0.7070 would be required at a minimum to take the immediate pressure off the downside. Until then, scope exists for deeper setbacks towards 0.6500.AUDUSD – fundamental overview

The Australian Dollar has been rallying in the aftermath of impressively strong Australian trade data. We've also seen broad based downside pressure on the USD. Still, weaker iron ore prices have weighed on the currency into rallies. Key standouts on Friday’s calendar come from the RBA SOMP, German industrial production, monthly employment reports out of Canada and the US, and Canada Ivey PMIs.USDCAD – technical overview

A recent surge back above 1.3000 signals an end to a period of bearish consolidation and suggests the market is in the process of carving out a more significant longer-term base. Next key resistance now comes in up into the 1.3500 area. Setbacks should be very well supported down into the 1.2500 area.USDCAD – fundamental overview

The Canadian Dollar was a relative underperformer on Thursday, clearly unable to ignore the fallout in the oil market. Economic data out of Canada was mixed on the whole. Key standouts on Friday’s calendar come from the RBA SOMP, German industrial production, monthly employment reports out of Canada and the US, and Canada Ivey PMIs.NZDUSD – technical overview

Overall pressure remains on the downside and conditions remain quite choppy. A break back above 0.6400 would be required to force a shift in the structure and suggest we are seeing a more significant bullish reversal. Until then, scope exists for fresh yearly lows and a retest of the major psychological barrier at 0.6000.NZDUSD – fundamental overview

The New Zealand Dollar was decently bid on Thursday, with the currency mostly supported on bigger picture themes and broad based US Dollar outflow. Key standouts on Friday’s calendar come from the RBA SOMP, German industrial production, monthly employment reports out of Canada and the US, and Canada Ivey PMIs.US SPX 500 – technical overview

Longer-term technical studies are in the process of unwinding from extended readings off record highs. Look for rallies to be well capped in favor of lower tops and lower lows. Back above 4,206 will be required at a minimum to take the immediate pressure off the downside. Next major support comes in around 3,400.US SPX 500 – fundamental overview

We've finally reached a point in the cycle where the Fed recognizes unanchored inflation expectations pose a greater downside risk than over-tightening. This is significant, as it means less investor friendly monetary policy that risks potential recession in the months ahead. And so, naturally, stocks have been under intense pressure in 2022.GOLD (SPOT) – technical overview

The 2019 breakout above the 2016 high at 1375 was a significant development, opening the door for fresh record highs. Setbacks should now be well supported above 1700 on a monthly close basis.GOLD (SPOT) – fundamental overview

The yellow metal continues to be well supported on dips with solid demand from medium and longer-term accounts. These players are more concerned about inflation risk and a less upbeat global growth outlook. All of this should keep the commodity well supported, with many market participants also fleeing to the hard asset as the grand dichotomy of record high equities and record low yields comes to an unnerving climax.