|

|

7 June 2022 Ether at risk for deeper setbacks |

| LMAX Digital performance |

|

LMAX Digital volumes were lower to start the week. Total notional volume for Monday came in at $456 million, 34% below 30-day average volume. Bitcoin volume printed $300 million on Monday, 30% below 30-day average volume. Ether volume came in at $102 million, 40% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,158 and average position size for ether at 3,647. There had been some signs of a pickup in volatility in May, though things have trended back down to yearly low levels in recent weeks. We’re now looking at average daily ranges in bitcoin and ether of $1,626 and $131 respectively. |

| Latest industry news |

|

All of the positive momentum from recent sessions has been wiped out, with bitcoin and ether coming back under intense pressure into Tuesday. Technically speaking, bitcoin had been showing some constructive tendencies after ending a sequence of consecutive weekly lower tops. But this is looking like a false break, as the market trades back down into consolidation off recent lows. Ether on the other hand, had yet to show bullish signs, with the currency confined below key consolidation resistance. This latest move to the downside suggests we are seeing a bearish consolidation, with a breakdown below $1,700 to strengthen this case. The next key level to watch below in the price of ether would be $1,400, which coincides with previous resistance now turned support in the form of the record high that was set back in 2018. All of this price action is tied to bigger picture macro themes around higher inflation and monetary policy normalization. Crypto markets have yet to break away from correlations with risk on, and as stocks come off, so too do crypto assets. Nevertheless, it’s important to highlight the expectation that during periods of risk off, we should continue to see bitcoin outperformance against ether and other cryptocurrencies. |

| LMAX Digital metrics | ||||

|

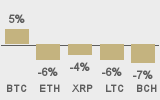

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

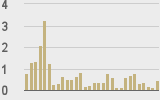

Total volumes last 30 days ($bn) |

||||

|

||||

|

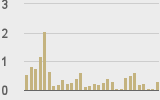

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@woonomic |

||||

|

@fintechfrank |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||